Top Guidelines Of Opening An Offshore Bank Account

Table of ContentsLittle Known Questions About Opening An Offshore Bank Account.The 6-Minute Rule for Opening An Offshore Bank AccountOpening An Offshore Bank Account for BeginnersThe Opening An Offshore Bank Account StatementsOur Opening An Offshore Bank Account PDFsOpening An Offshore Bank Account for Beginners

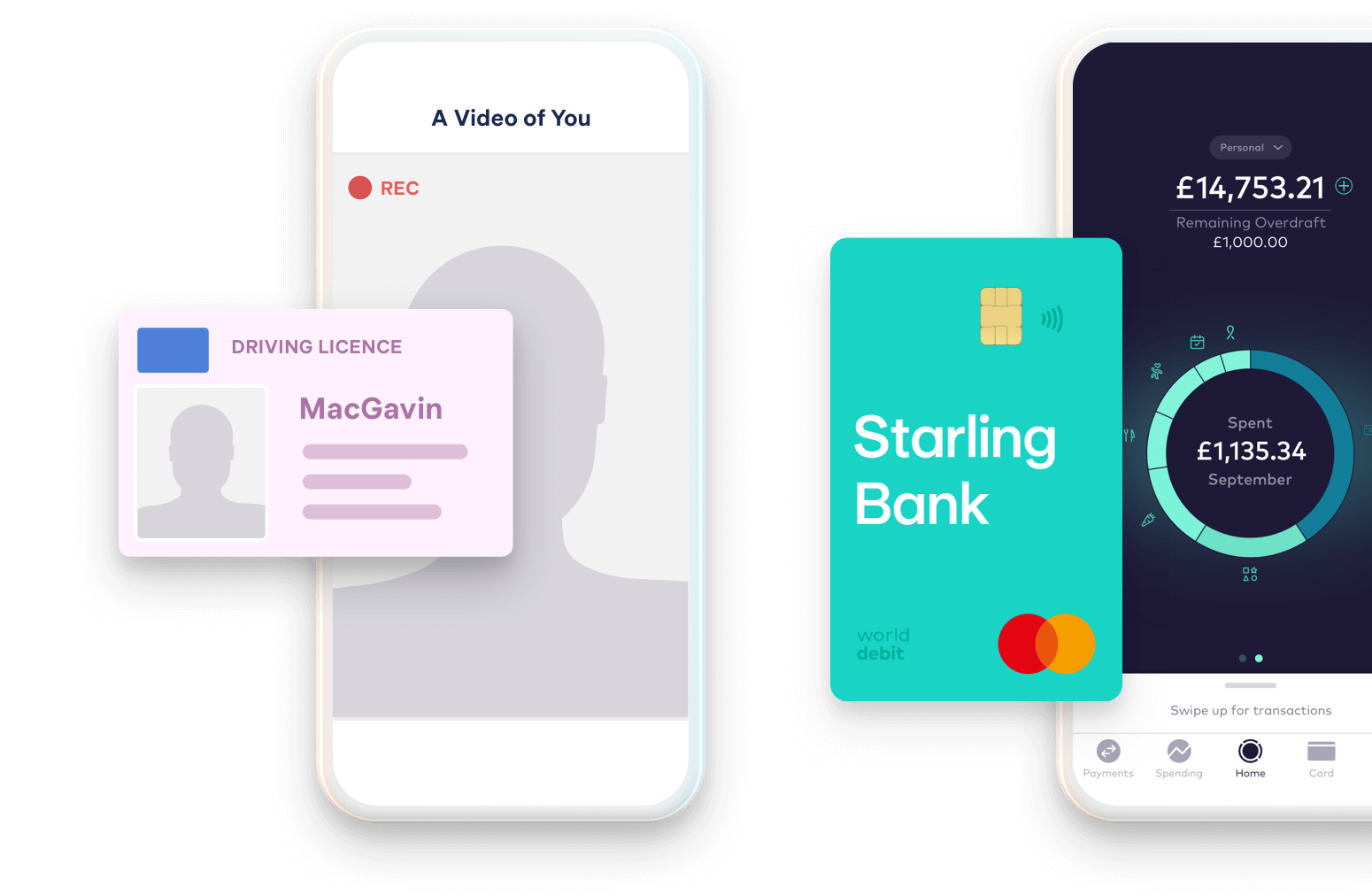

Whether you're considering transferring to the UK or you've gotten here there already, at some factor you're going to need a bank account. In the past, opening up a bank account in the UK was extremely hard if you were new to the country. The good news is, these days, it's ended up being a little simpler (opening an offshore bank account).As soon as you've transformed your address, ask your bank to send out a bank statement to your new address by post, as well as you'll have a document that proves your UK address. If you don't have an evidence of address in the UK as well as you need to open up an account, Wise's multi-currency account may be the ideal option for you.

Can I open a bank account prior to I show up in the UK? Yes, you can. Your home bank may have the ability to establish up a represent you if it has a contributor banking relationship with a British bank - opening an offshore bank account. Numerous significant UK financial institutions additionally have supposed. These are made especially for non-residents, so they're a great alternative if you don't have the papers to verify your UK address.

The Ultimate Guide To Opening An Offshore Bank Account

This can make your checking account costly to open up as well as run, specifically if you still don't have a task. There may additionally be other limitations. You may not be able to close the account as well as button to a better deal till a collection duration of time expires. The Wise multi-currency account.

Some banks are stringent with their needs, so opening a savings account with them will be difficult. What is the easiest savings account to open up in the UK? It's normally simpler to open up an account with one of the - Barclays, Lloyds, HSBC or Nat, West. These banks have actually been in organization for a long time and are very secure.

Excitement About Opening An Offshore Bank Account

Barclays Barclays is one of the earliest financial institutions in the UK; and has even more than 1500 branches around the country. It's also probably one of the easiest banks to open an account with if you're new to the UK.

The account is complimentary as well as comes with a contactless visa debit card as requirement. You won't be able to utilize your account instantly.

Barclays also provides a few different organization accounts, depending upon the yearly turn over rate. You can obtain in touch with client support using a live chat, where you can discuss the details of your application as well as ask concerns in real time. Lloyds Lloyds is the largest carrier of existing accounts in the UK, and also has around 1100 branches throughout find out here now the country.

Opening An Offshore Bank Account - An Overview

You can get in touch with consumer support by means of a real-time conversation, where you can go over the details of your application and ask any kind of inquiries in genuine time. Various other financial institutions worth looking into While Barclays, Lloyds, HSBC and also Nat, West are the 4 most significant financial institutions in the UK, there are likewise various other banks you can inspect.

Of course, it's always best to look at what different banks need to supply as well as see who has the ideal offer. Don't devote to an item without a minimum of having a look at what else is around. What are the costs? You can get a standard bank account at no monthly cost from a lot of high road financial institutions.

A lot of financial institutions also have exceptional accounts that provide fringe benefits such as cashback on home costs, in-credit rate of interest and also insurance policy. These accounts will certainly commonly have month-to-month costs and minimal qualification demands; and you might not qualify if you're new to the UK. You'll also need to be careful to stay in credit history.

The Definitive Guide to Opening An Offshore Bank Account

If you're not using one of your financial institution's ATMs, check the device. Lots of banks will charge a, which can be as high navigate to this site as 2.

When you open this account, you'll have the alternative to take out an. A prepared over-limit enables you to borrow cash (up to an agreed limitation) if there's no money left in your account.

Opening An Offshore Bank Account Things To Know Before You Buy

We'll constantly try to enable essential repayments if we can - opening an offshore bank account. You can look for a prepared overdraft account when you open your account, or at any moment later on. You can ask to increase, remove or minimize your limitation at any moment in online or mobile financial, by phone or in-branch.

We report account task, including over-limit use, to credit score recommendation agencies. This account comes with a.